Grandparents to determine holiday trends in toys market in 2022

19 Jul 2022

It is no secret that grandparents love to spoil their grandchildren with gifts and toys; are a natural. Toys are number one choice when it comes to gifting. The pandemic has made children and their parents more interested in certain categories of toys focusing on experiential learning rather than play alone. The grandparents are beginning to catchup, and they will be there for the Holiday Season in 2022.

The toys market in the US has grown by a whopping 40% since the pandemic. The growth in the sports & outdoor toys spiked driven by greater interest in sports at or near home. A segment that showed the highest growth in the revenue were the experiential learning toys. The segment includes puzzles, explorative toys, and building sets. Parents prefer their children to engage proactively rather than merely playing with toys.

The pandemic period also saw the decline in the release of movies which usually drives the sale of action figures and dolls.

The Toys market saw a growth of 40% since the pandemic. Sports & Outdoor have shown the largest growth. The three categories that have also shown significant growth are games/puzzles, building toys and explorative toys.

Experiential toys contributed to a quarter of the revenue in pre-pandemic period in the games and toys sector. Analysis by Ongil.ai shows that this segment has contributed to 40% of the revenue growth in the toys sector since then*.

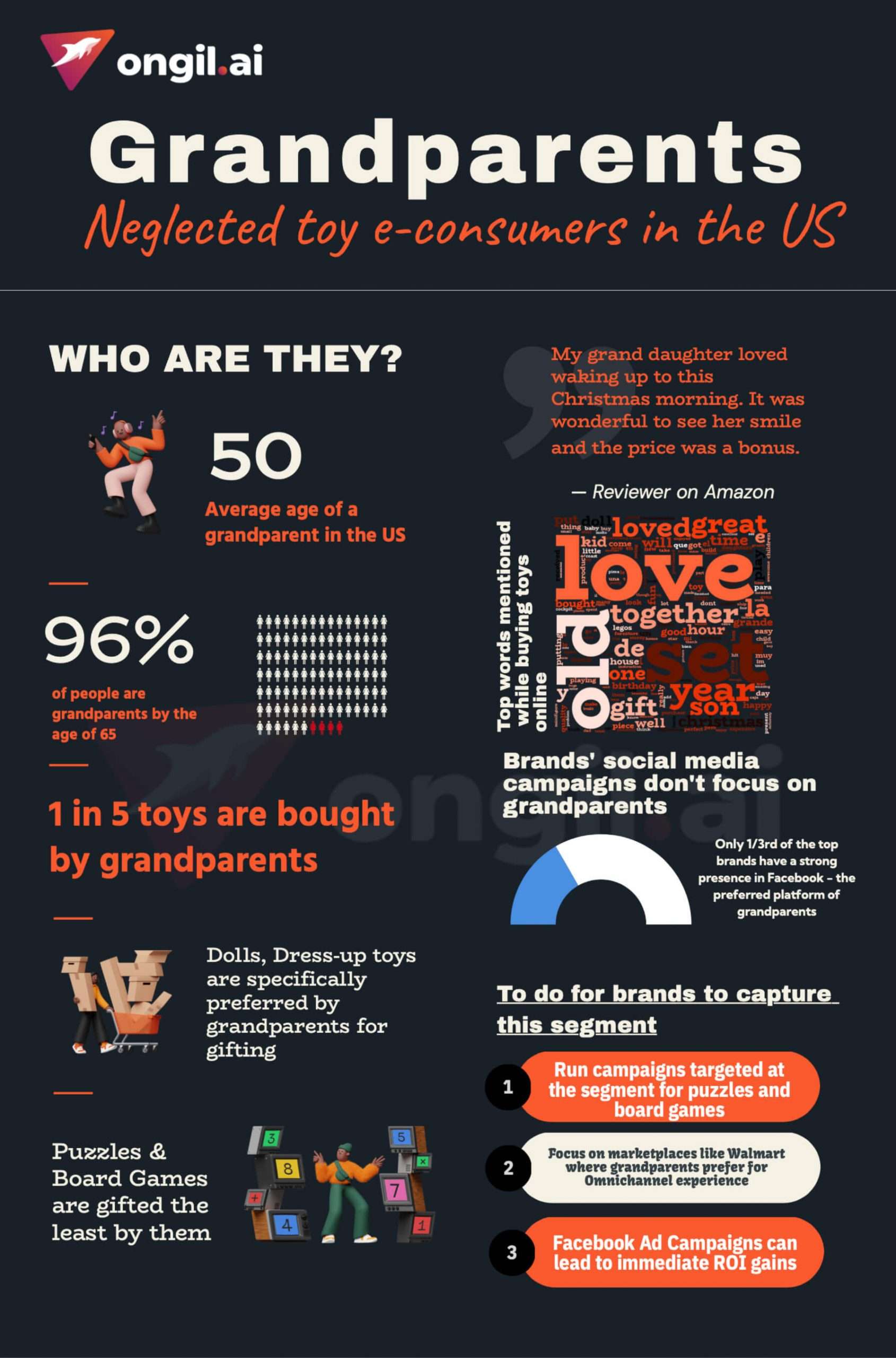

Grandparents play an important role in the lives of their grandchildren as mentors, caregivers, and contribute financially too. The spend by grandparents on grandchildren is estimated to be $179 Billion annually. Gifts are the number one form in which grandparents spend on their grandchildren. Further, the number of grandparents have grown by 24% in the past two decades and is estimated to grow further. This means that the spend by grandparents will increase significantly. A grandparent of today is estimated to have about 4 grandchildren. Therefore, grandparents are connected to more children than parents.

Photo by Mikhail Nilov: https://www.pexels.com/photo/a-woman-doing-yoga-with-her-granddaughter-8307436/ Grand parents see themselves as sources of wisdom and mentors. They actively discuss everything from education to entertainment with their grandchildren

Grandparents of today retire later than the previous generation. This has resulted in the fact that grandparents earn more than the parents. More than three-quarters are likely to own a smartphone, and in general more tech-savvy than the previous generations.

Grandparents account for 20% of all sales in the toys industry. Since most grandparents don’t live with their grandchildren, they are likelier to infer overall trends in the market as buying signals. Further, grandparents are less likely to evaluate a toy through value for money, quality, and durability. As one would expect, the joy the toy provides to the grandchild is the overwhelming determinant of satisfaction with a toy.

There is a mismatch between the movement of the market towards experiential toys and grandparents’ purchasing behavior.

Ongil.ai’s analysis reveals that grandparents have spent more in the dolls, action figures category than in puzzles or board games (Games & Accessories in the figure). In fact, grandparents underbuy by about 60-80% in both the cases. On the other hand, they tend to buy more than the market in the Dress-up and the dolls segments. These have been segments which have sold high even before the pandemic. Apart from this, building toys is a segment where they have been outbuying the market significantly. It must be pointed out that in the case of building blocks, the number of choices in terms of sub-categories that the buyer has to choose from is relatively limited. Further, analysis of why building blocks are growing irrespective of consumer segment and what type of building blocks contribute to this will be taken up in the next part of the series.

However, grandparents don’t tend to stay behind overall trends for long. For example, they are active buyers of recently popular products that require a mobile app to control them. Further, given the increasing proliferation of e-commerce among older segments, it is very important that brands understand the segment to stay ahead of competition.

The above figure shows the sub-categories in toys where grandparents buy more or less than the overall market trends in e-commerce. It is evident that they tend to be comfortable buying traditionally popular toy types.

Despite the mountain of evidence that grandparents are an important segment to focus on, brands are not doing it. Despite the recent decline in usage, Facebook is by far the most popular social media platform among people who are 50 and beyond. Most brands are not as active as they are on Instagram#. Analysis by Ongil.ai reveals that, one-third of the top 75 toy brands surveyed have bigger presence in Instagram than Facebook. This even though Instagram is a smaller medium. Even the larger brands like Lego and Mattel, have a much stronger presence in Instagram than Facebook (accounting for the relative sizes of the media).

The toys market is growing faster in the online space as compared to the offline market. While Toys R Us may not happen every day, new gain share and revenue growth are likelier to happen online. Amazon is the clear leader in the toys segment online. Walmart too has an increasingly strong presence in the segment. Further, given that a significant section especially researches online before buying offline Walmart could be a good option to reach grandparents – especially in the rural areas.

Grandparents consider themselves more of sources of wisdom than being a friend. They also discuss everything from school/college plans to movies & tv. Effective positioning of the experiential toys as one that would strengthen their relationships with their grandchildren can significantly boost the sales. Brands will have to act rapidly to capture the attention of grandparents before the fight for the Holiday shopping snowballs.

In Summary:

- Grandparents are an important segment of toy buyers. With the changing demographics, they have more affluence to spend money on their grandchildren.

- Experiential Toys segment has been growing the fastest since the pandemic. However, based on Ongil.ai’s analysis of consumer reviews it is apparent that grandparents are not actively gifting such toys yet.

- Brands which effectively address this gap can emerge winners.

- They can achieve this by

- Being visible in social media that grandparents use more.

- Choose online platforms of choice wisely. Walmart which provides online visibility along with offline convenience is likely to be a better choice over Amazon.

- Consider the changing role of grandparents to being active mentors to pitch experiential toys appropriately to them.

Join ⚡️ Ongil.ai community

Highly sector specific insights to drive actions for free. We are starting with the Toys & Games segment.

No fluff. No rehashing of old content. Insights to Implement